psyPhon: Enron Case Study

It’s a rite-of-passage… of sorts. Any new legal analytics technology that shows up must pass through the doors of the Enron corpus weight room, pick up the Enron dumbbells, and flex its metaphorical muscles. So we sent psyPhon in to work-out. Let’s take a look at the results.

Two ‘STOP’ signs could have been raised if Enron’s Audit & Accounting Firm was using psyPhon. The first may have prevented the catastrophic aspect of Enron’s $111 billion & 6,000 employee vanishing act, but the second could have saved the demise of the historic 89 year old, $10 billion a year, 85,000 employee Audit & Accounting Firm itself.

Quick background. Enron was an American energy trading company. Around December 2000 it was valued at $111 billion. By December 2001 it had collapsed to zero. A legend of the global audit and accounting industry, with $10 billion in annual revenues, an 89 year history and 85,000 employees worldwide, Arthur Andersen was responsible for auditing Enron’s accounting practices and ensuring that the financials reported to the government and investors was accurate. In 2002 it closed its doors, convicted of charges related to Enron’s fraudulent practices that led to Enron’s demise.

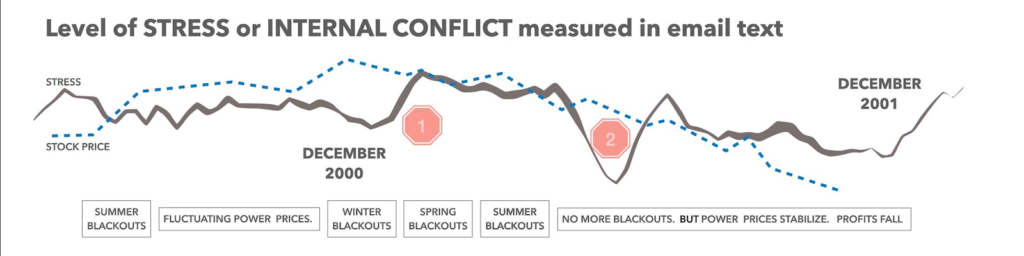

psyPhon processed the text of thousands of emails written by Enron executives from summer 2000, through spring of 2002. Using algorithms based on cognitive linguistics [1] it assigned a numerical value between 0 and 1 to the level of stress or internal conflict in each email, represented by the difference in the two types of thinking unconscious and rational [2]. The level of stress was plotted over time.

The first point of interest shows up around spring of 2000. The period immediately before that point shows a steep increase in stress levels which is preceded by months of wild fluctuations of power rates and blackouts in California, a major customer of Enron. psyPhon was then used to rank-order emails with most stressful on the top and also to highlight the content and context in the emails that is contributing to the stress. A quick review reveals frenzied activity by Enron executives to ‘solve’ the California power crisis by using back door channels to influence the politicians to pass legislation that would ‘blame’ the problem on earlier legislation that limited the buying power in the state to a handful of agencies, reverse those laws and in effect provide more opportunity for Enron to manipulate prices, cause congestion and charge higher congestion rates like the ‘surge pricing’ we’re now familiar with for ride-share companies. Enron’s high-level revenues looked good at that time and Arthur Andersen did not did any deeper. In fact the Arthur Andersen chief auditor responsible for Enron at that time, Carl Bass, had raised issues about Enron’s practices, but in the absence of anything to back his claims, he was removed from the position enabling Enron to continue. It could be imagined that if Carl Bass had access to psyPhon he might have been able to back up his claims and slow down or soften the impact of the train wreck that Enron ended up as 9 months later.

The second point of interest shows up during end of the first quarter of 2001 and start of the third quarter. First the stress levels take a sharp downward turn. Prior to that Enron kept making profits from its sales in California while the state continued having power blackouts. psyPhon analysis shows that the emails are about the possibility of Enron getting away with the manipulations and fake congestions they created for California through a federally brokered price cap and back-door deals with the governor Gray Davis, house speaker Hertzberg and gubernatorial candidate at them time Arnold Schwarzenegger.

The price cap went into effect and the electric power situation in California stabilized. However, this created a secondary and more intractable problem. While Enron was making profits off California they had begun a practice of borrowing money collateralized by its stock price with trigger conditions that the loans would become due in full if the stock price dipped below a certain number. While the price cap allowed Enron to brush the past rate manipulations under the carpet, it also limited its profitability, which in turn put a downward pressure on its stock price. psyPhon analysis shows that the emails from the period of the sharp uptick in stress correspond to questions about the loan contracts and concern about severe financial distress if the stock price keeps sliding. Again one could imagine that if the Auditor had access to such content analysis, maybe Arthur Andersen could have distanced itself from Enron. Instead, towards the end of the third quarter, Arthur Andresen once again dismissed the assigned chief auditor, this time a Mr. David Duncan and opened up a dedicated ‘Shred Room’ to destroy truckloads of accounting audit documents from the recent months. Later on after Enron’s collapse, the ‘Shred Room’ became the key tipping point leading to a guilty verdict against Arthur Andersen for its failure to carry out its fiduciary duties, thus closing the 89 year old firm and 85,000 jobs worldwide.

Could a tool like psyPhon have softened the catastrophic aspect of Enron’s collapse or prevented the demise of Arthur Andersen? Not by itself. In the end data does not make decisions, people make decisions. Could a tool like psyPhon have provided meaningful data to alter the course of events? That it seems it would have done really well.

[1] “Cognitive Linguistics is a modern school of linguistics which Investigates the relationship between, Language, Thinking and Socio-physical experience” Cognitive Linguistics: A Complete Guide, Vyvyan Evans, Edinburgh University Press, 2019.

[2] “Thinking, Fast and Slow, Daniel Kahneman, Farrar, Straus and Giroux, 2011” Presents a model of cognition and thinking as two types. Type 1 thinking operates automatically and quickly, with little or no effort and no sense of voluntary control (unconscious). Type 2 thinking allocates attention to the effortful mental activities that demand it, including complex computations (rational).